How to Generate & Download Meesho GST Report

Meesho is the most popular platform nowadays among sellers to get good sales, and every Meesho seller has to file a GST return with the regulator monthly. Sometime sellers self-file GST returns or files by CA or any other professional, but for that, the seller has to send or require a GST return file for the return filing month, but most sellers confuse which file to generate and how to download the Meesho GST report from the seller panel. So in this article i provide you step-by-step process how to download Meesho GST report file.

Steps to Download a GST Report

Step 1: Open the Meesho Seller Panel.

open https://supplier.meesho.com/ in your browser.

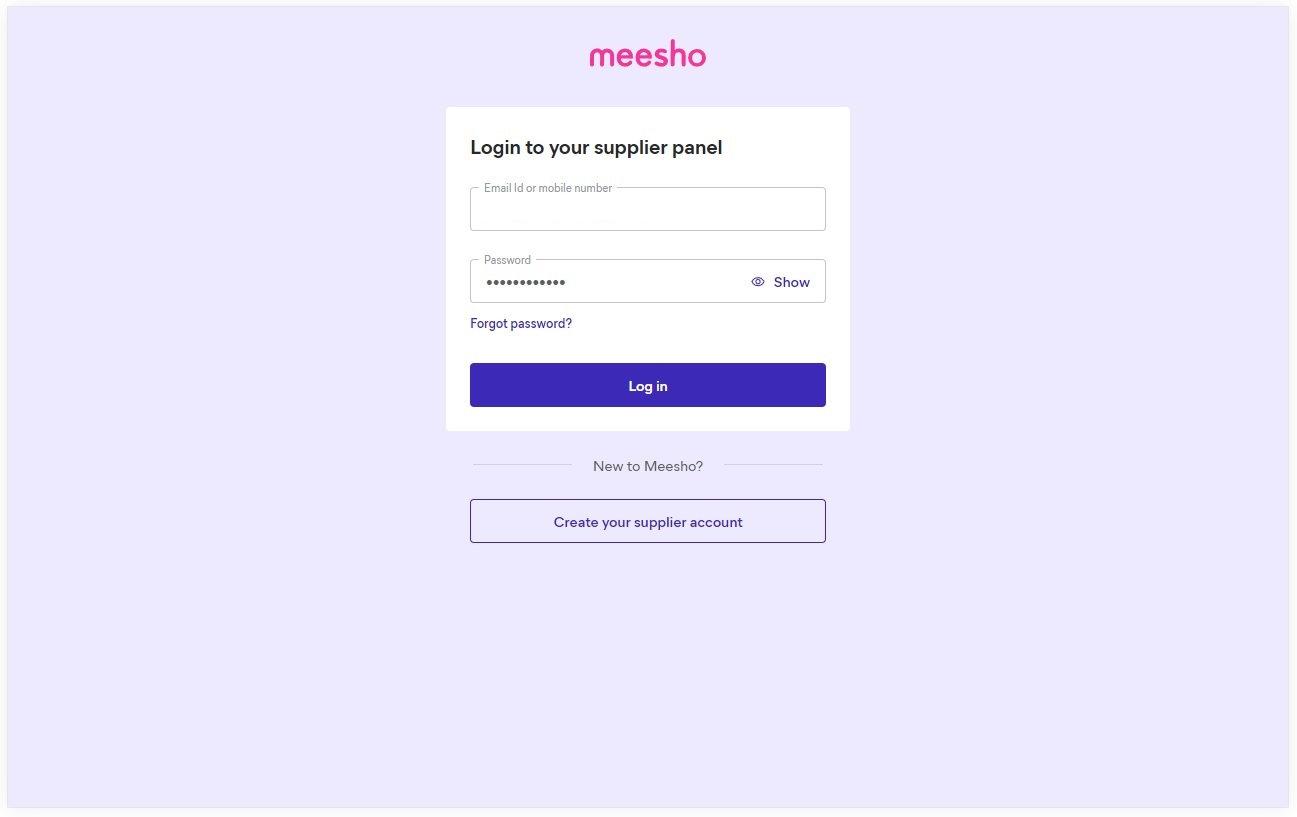

Step 2: Login to the Meesho Account

After opening the page, login to your Meesho seller using your registered email ID and password.

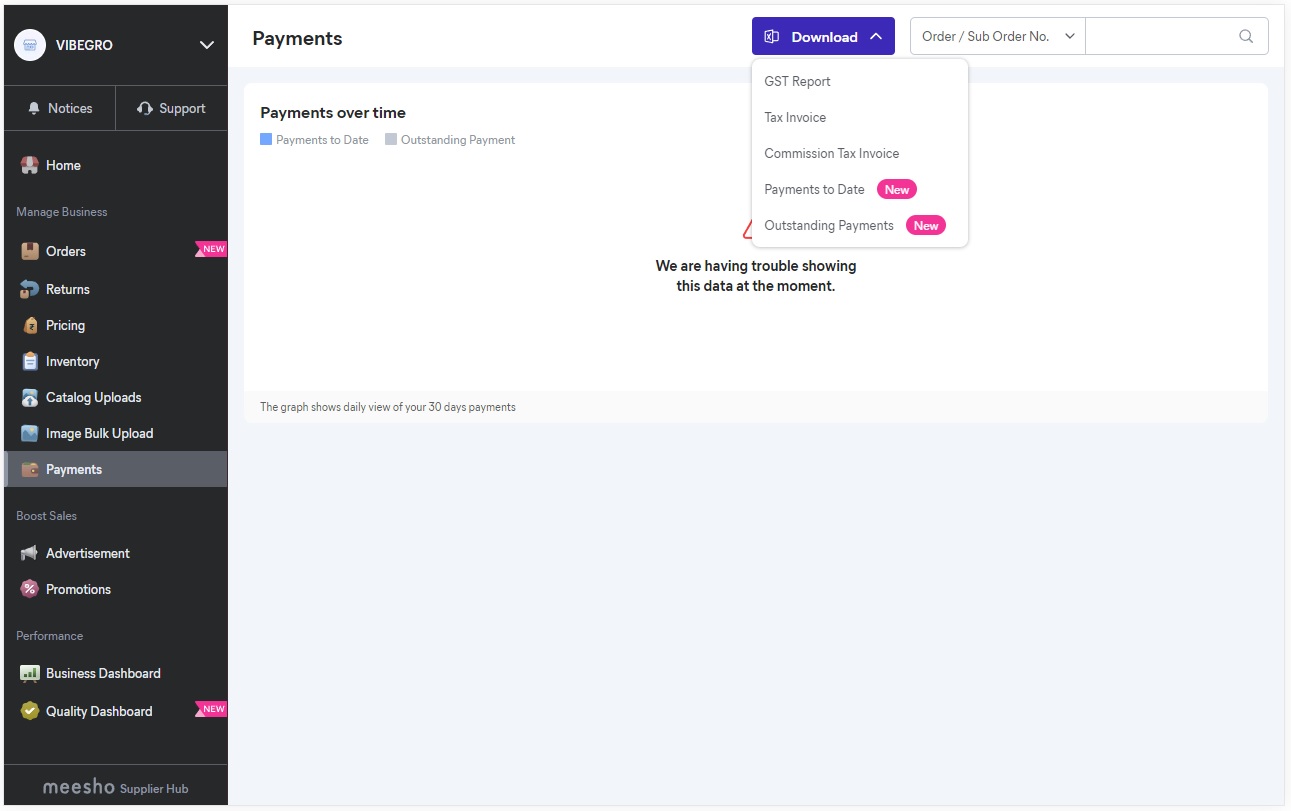

Step 3: Navigate to the GST Report

Once logged in, on the dashboard, find and click the Payment option under the Manager Business section on the left side menu. On the payment page, navigate the drop-down menu on the top side. Download and click GST Report from the drop-down menu.

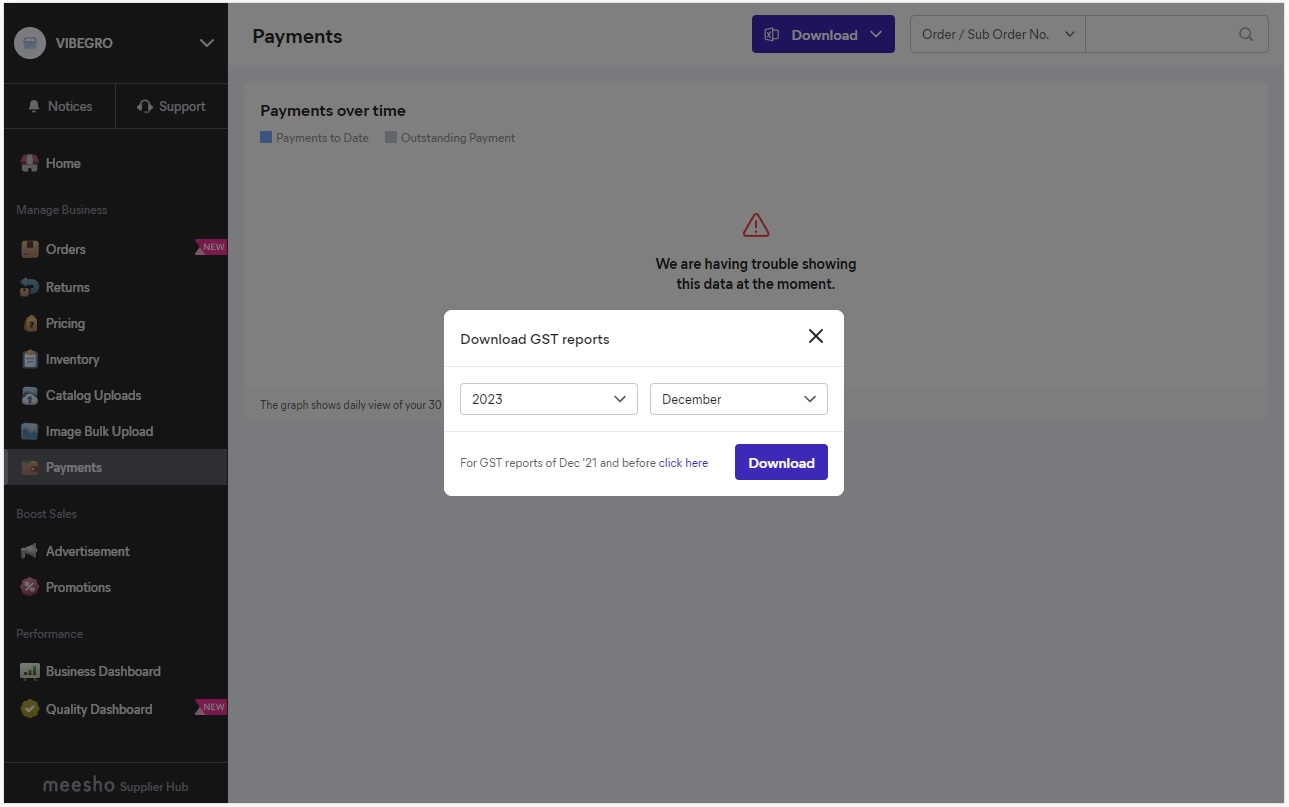

Step 4: Select Date Range

Before downloading the GST report, select the month and year for which you want to download the report. After selection, click the Download button to start downloading the file.

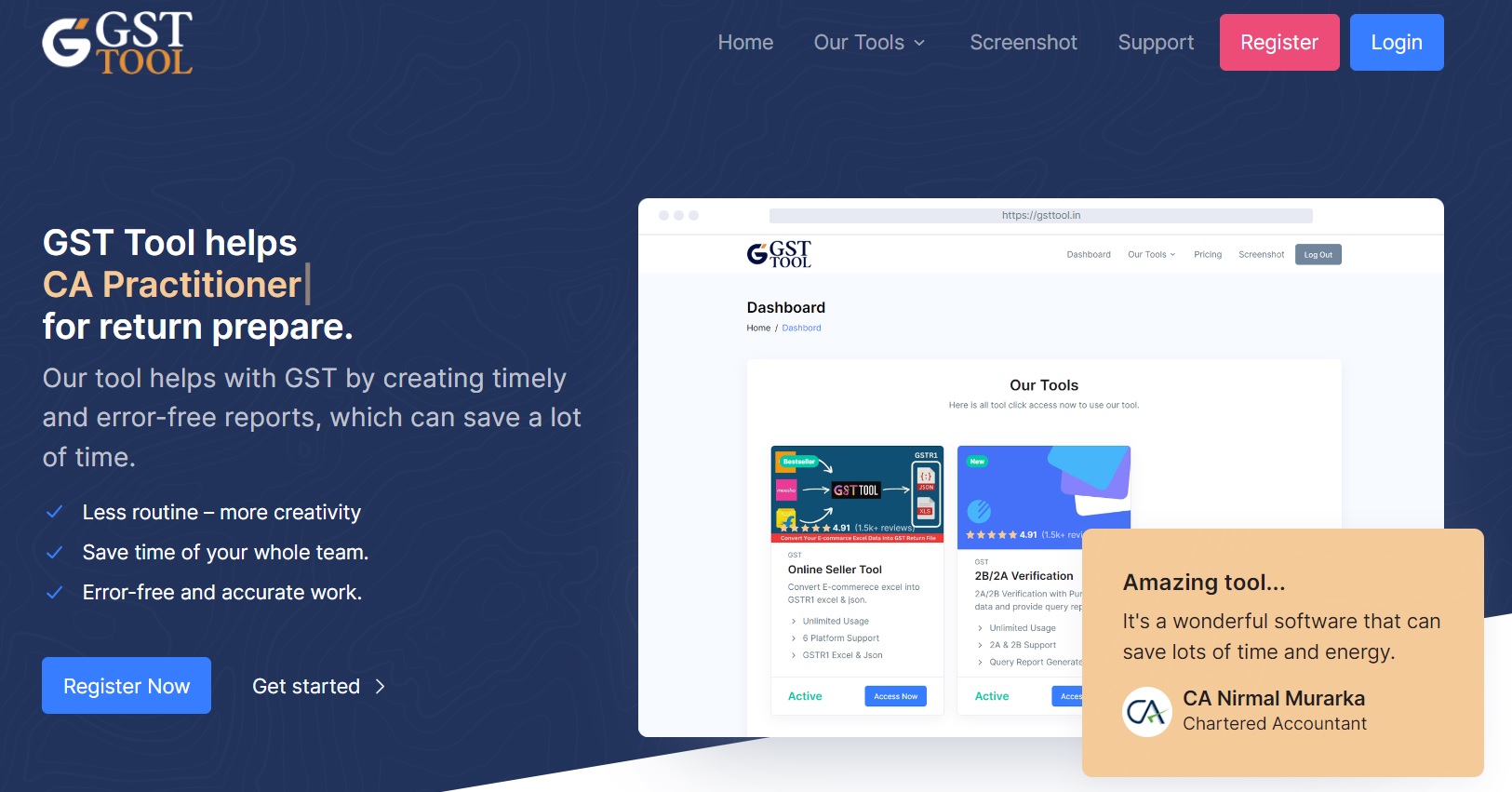

Step 5: Convert Excel into GSTR1 JSON using GST Tool.

You can file your GST return yourself for free using the GST Tool. Simply import your downloaded data from Meesho, and with one click, convert your Meesho data into GSTR1 JSON format, which can be directly uploaded to the GST portal for filing.

For more information and to learn how to use the GST Tool, click here.

Other option you can send the downloaded zip file to your CA or any other professional for GST return filing. This is a simple process that every Meesho seller is required to comply with every month to comply with the GST requirement. Please note that the Meesho GST report is available for download after the 5th date of next month. GST returns should be filed before the 20th month; otherwise, late filing fees will be liable.

GST Online Seller

Convert E-Commerce Data To GSTR1 Excel/Json